SMARTER THIRD-PARTY RISK MANAGEMENT STARTS HERE

Trusted by 3,500+ companies to streamline oversight and reduce third-party risk. Optimize your risk management with industry-leading TPRM software, built to help you meet stringent U.S. regulatory expectations, monitor supply chain, vendor, and partner risk, and protect your business with confidence.

TRUSTED BY THOUSANDS OF LEADING BRANDS

-1.png?width=168&height=50&name=Untitled%20design%20(37)-1.png)

TPRM SOFTWARE BUILT FOR U.S. REGULATIONS

Modern US businesses are exposed to escalating third-party risks, from vendor data breaches to regulatory fines for oversight failures. Our third-party risk management platform automates onboarding, due diligence, risk scoring, and continuous vendor monitoring, offering end-to-end control that supports the latest US regulatory requirements and best practices. Avoid substantial fines and reputational harm, protect your business and satisfy all relevant compliance standards with an integrated TPRM solution.

.png)

Our platform delivers dashboards and reports aligned with FFIEC, OCC, FDIC, and industry standards, meeting both internal and regulatory requirements.

Seamless integration with your existing compliance systems ensures effortless adoption, eliminating disruption while strengthening oversight.

Together, these tools streamline reporting, simplify compliance, and keep your risk management connected and audit-ready.

BUILT FOR BUSY TEAMS

Configurable Risk Assessment Tools

Instantly evaluate third parties with customizable risk templates, analytics, and automated scoring built to address US oversight frameworks.

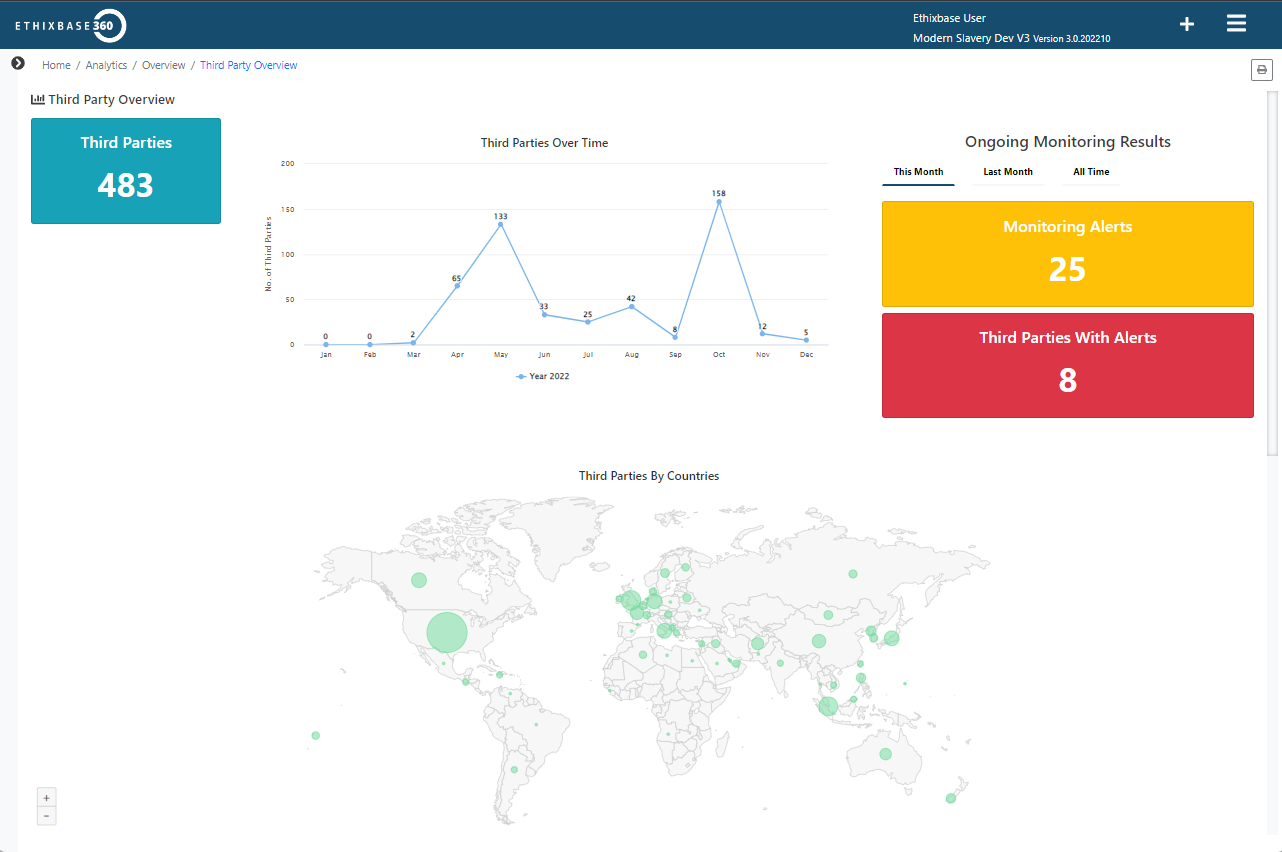

Continuous Third-Party Risk Monitoring

Receive real-time alerts on changes to vendor risk ratings or compliance standing, including integration with federal reporting requirements.

Automated Due Diligence & Documentation

Launch, collect, and track due diligence questionnaires and certifications at scale, keeping all records audit-ready and accessible.

Centralized Compliance & Evidence Management

Streamline ongoing documentation, reporting, and certification renewals for complete regulatory readiness.

Federal agencies like the Federal Reserve Board, OCC, and FDIC have heightened expectations for third-party risk management. Recent enforcement actions have imposed multi-million-dollar penalties on organizations lacking adequate vendor oversight. Failures in vendor data security alone have triggered fines exceeding $60 million for major banks, underscoring the urgent need for strong due diligence, ongoing monitoring, and clear evidence of compliance. Across finance, healthcare, technology, and retail, companies face increasing cyber and operational risks from third-party networks.

Leading US organizations now use TPRM platforms to:

- Identify, assess, and mitigate vendor and partner risks

- Ensure compliance with federal and industry standards

- Avoid costly penalties and reputational harm

- Deliver rapid, auditable responses to regulators

REAL-TIME COMPLIANCE, GLOBAL SCALE

0+

Clients

0+

Platform Users

0+

Third Parties Monitored Daily

0+

Languages Analysed for Global Risk Insights

GUIDEBOOK DOWNLOAD

Third-Party Risk in the Era of Perma-Crisis: Navigating the New Normal

Download the 2025 guide to managing third-party risk in a volatile world, built for legal, risk, and compliance leaders navigating shifting regulations and global uncertainty..png?width=398&height=280&name=Third-Party%20Risk%20in%20the%20Era%20of%20Perma-Crisis%20Navigating%20the%20New%20Normal%20%20(2).png)

.png?width=720&height=480&name=case%20study%20cover%20(3).png)

CASE STUDIES

Asahi Refining

Asahi Refining North America, a company specializing in precious metals, sought to enhance its third party compliance and risk management processes.

CASE STUDIES

Edwards

Following a period of rapid growth, the company began facing challenges with fragmented regional compliance processes and disconnected internal systems.

.png?width=720&height=480&name=case%20study%20cover%20(4).png)

CASE STUDIES

Sonova

From manual to automated, we accelerated and simplified their entire third-party compliance and due diligence process for Sonova, a leading global medical device company.

FREQUENTLY ASKED QUESTIONS

What Are the Main US Regulations Impacting Third-Party Risk Management? +

Key federal guidelines stem from the Federal Reserve, OCC, FDIC, FTC, and industry groups such as the FFIEC. Guidance includes clear expectations for due diligence, risk monitoring, and incident response for all material third-party relationships.

What Are the Consequences of Weak Third-Party Risk Management? +

Poor oversight can result in regulatory enforcement, fines upward of $100,000 and up to $60 million, lost business, lawsuits, and reputational harm.

Which Types of Third-Party Risks Are Most Critical? +

Operational disruption, cybersecurity/data privacy, financial crime, and compliance failures are top priorities cited by US regulators and industry experts.

Let's Talk

Ready to take the risk out of the equation?

.png?width=1050&height=1050&name=Untitled%20design%20(33).png)